Hourly salary after taxes

How do I calculate hourly rate. Its set to raise the standard salary to over 35000 annually.

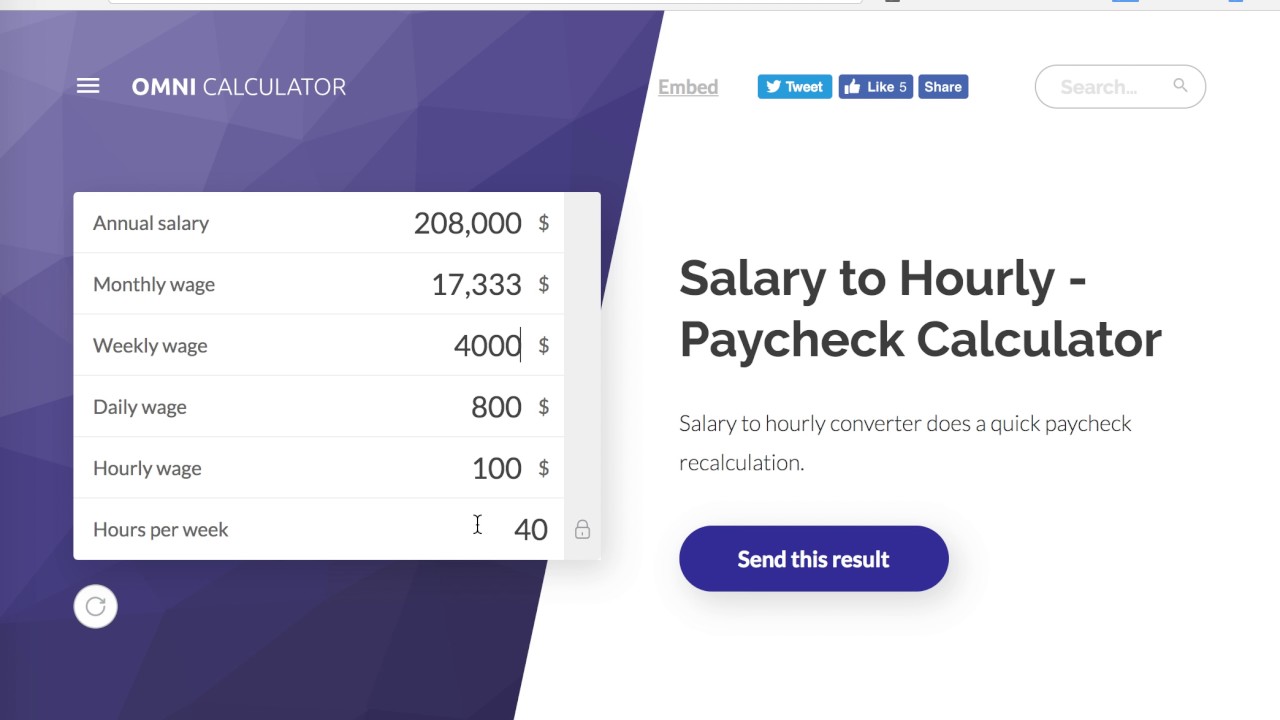

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

But after paying 25 in taxes your after-tax salary would be 34320 a year.

. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. If you are paid 60000 a year then divide that by 12 to get 5000 per month. Your average tax rate is.

Before versus after tax income. If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. If you make 22 an hour you would take home 34320 a year after taxes.

See where that hard-earned money goes - Federal Income Tax Social Security and. If you know you work 40 hours a week for 50 weeks a year then you would multiply the hourly stated wage by. Ad See the Paycheck Tools your competitors are already using - Start Now.

How to calculate annual income. If you make 20 an hour you make approximately 40000 a year. 37 x 50.

The Canada Hourly Tax Calculator is updated for the 202223 tax year. Read reviews on the premier Paycheck Tools in the industry. The new guidelines which will be effective on January 1 2020 states the following principles.

With a 281000 salary and taxes paid in Wyoming your net. There are two options. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

That means that your net pay will be 43041 per year or 3587 per month. For example for 5 hours a month at time and a half enter 5 15. Enter your Hourly salary and click calculate.

You can calculate your Hourly take home pay based of your Hourly gross income and the tax allowances tax credits. Next divide this number from the. This places US on the 4th place out of 72 countries in the.

By deducting a 25 tax rate from the 40 hourly rate you will find your after-tax hourly rate is 10 less than your pre-tax rate. For example if an employee earns 1500. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. If you make 55000 a year living in the region of New York USA you will be taxed 11959. Find out the benefit of that overtime.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Just as a reminder before taxes your salary is. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Your pre-tax salary was 45760. Calculating the hourly rate from your net income after taxes is important because you can not avoid paying taxes. For a quick estimate of your annual salary double your hourly salary and add a.

First calculate the number of hours per year Sara works. Enter the number of hours and the rate at which you will get paid. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

19 an Hour Salary After Taxes in 2022 By State Here is your estimated 19 an hour annual salary after taxes in 2022 for each state. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. DOL is increasing the.

Free for personal use.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Salary Slip Template Free Word Templates Survey Template Word Template Payroll Template

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Salary To Hourly Calculator

Sole Proprietor Vs S Corporation In 2019 S Corporation Sole Proprietor Payroll Taxes

Pin On Aztemplates Org

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Yearly After Tax Income For 100k Yearly Salary In The United States The Federal Income Tax On A 100k Yearly Salar Salary Federal Income Tax Additional Income

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Money Net Income Credit Card Debt Relief Income

21 Free Payslip Templates Printable Word Excel Pdf Templates Payroll Template Word Template

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables